sProblem statement

We noticed that many of the companies transacting on the xChange Leasing & Trading marketplaces also needed vessel slots. However, there was no good digital solution for that process. Hence, as a growth project, we tried to grow our market in that direction I joined the team in order to build the MVP.

Mission: Create an Ocean Freight marketplace for xChange customers

Goal: Get early traction (bookings & customers) onto our platform – either through new customers or converting them from other xChange products

Early MVP & first learnings

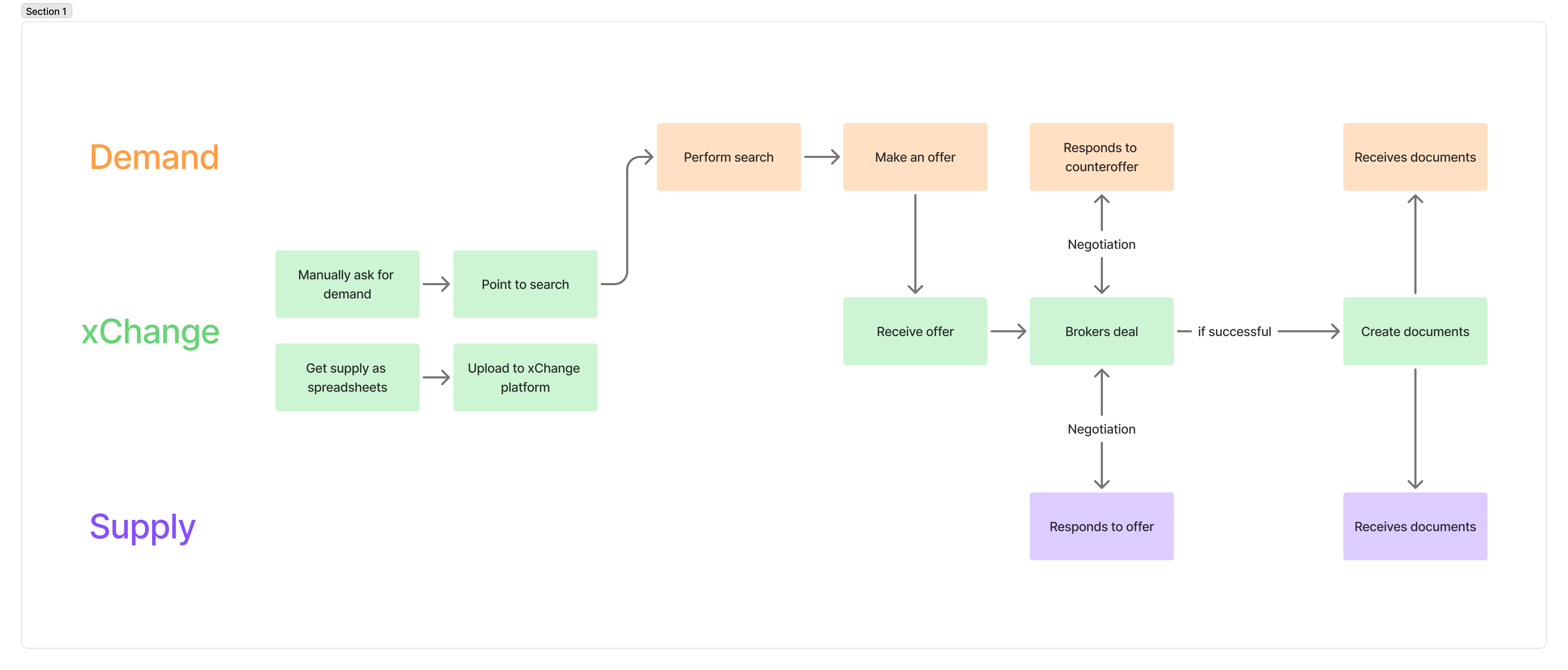

Our initial MVP was more of a proof of concept that we could collect further insights with. Through internal relationships, we managed to get some dedicated supply, and so the MVP would consist of a search and a basic mechanic for the demand-side to send an offer to the supplier. This offer would then be picked by us internally as a 'Wizard of Oz'.

We were able to see early traction, measured by the amount of searches and offers made. However, the volume was very low and the conversion rate was basically zero.

Research & Refining

We started talking to more suppliers and demanders to understand the market and user needs better. We learned the following things:

- The market is divided into shipper-owned containers (SOC) and carrier-owned containers (COC). SOC is only the slow and the demand-side would have to bring their own containers. COC is a bundle of a slot and provided containers.

- The COC market is dominated by large suppliers (MSC, Maersk, …) whereas the SOC market is mostly supplied by smaller so-called feeder lines. These feeder lines usually operate regionally and cover smaller ports that big containers ships don't navigate to. The companies who offer COC often have their own tools, so entering that market would be hard.

- There is a lot of sub-leasing going on in the SOC market. It's not uncommon for company A to own the vessel, giving a certain amount of slots to company B who then sub-lease to company C.

- Slot prices change on a regular basis and can be quite volatile at times. It's very common outside of the US and Europe for slot prices to be negotiated between the supply and demand parties.

- The process generally works through emails, phone calls and personal relationships. Forcing suppliers to use our platform would generate additional work for them which they weren't willing to put up with.

- All inventory was usually managed through a set of spreadsheets.

- Shipments generally follow a regular schedules (e.g. serving the same route, departing Monday each week). It's common for cargo and containers to be moved to the following shipment.

Iteration

With this new knowledge, we decided to target our product better. Initially, we would target the ME / ISC market (Middle-East & Indian Sub-Continent) for two reasons:

- This market mainly consisted of feeder lines who rented out SOC slots

- There were many of the most frequently used ports in the area (e.g. Jebel Ali (Dubai), Karachi and Mumbai).

Accordingly we stopped all focus on COC and started thinking about how to adapt the product:

📤 Find a way to get supply onto our platform without having the suppliers maintain it themselves.

🔍 Enable users to search for more parameters and see more relevant data in the results.

🤝 Improve the negotiation mechanic so we could lose the 'Wizard of Oz' workflow and enable self-service.

📄 Enable supply & demand to share images, documents and other data.

📘 Enable supply & demand to get an overview of their ongoing negotiations and completed bookings.

Search results

The new search results would show multiple parameters that were not present before:

- Multiple rates for different container types / slot sizes

- Expiry date of the offer

- Whether the rate was for empty or full containers (adding weight to the ship would cost extra)

- Port terms (what services would be included at gate-in and gate-out at the specific port)

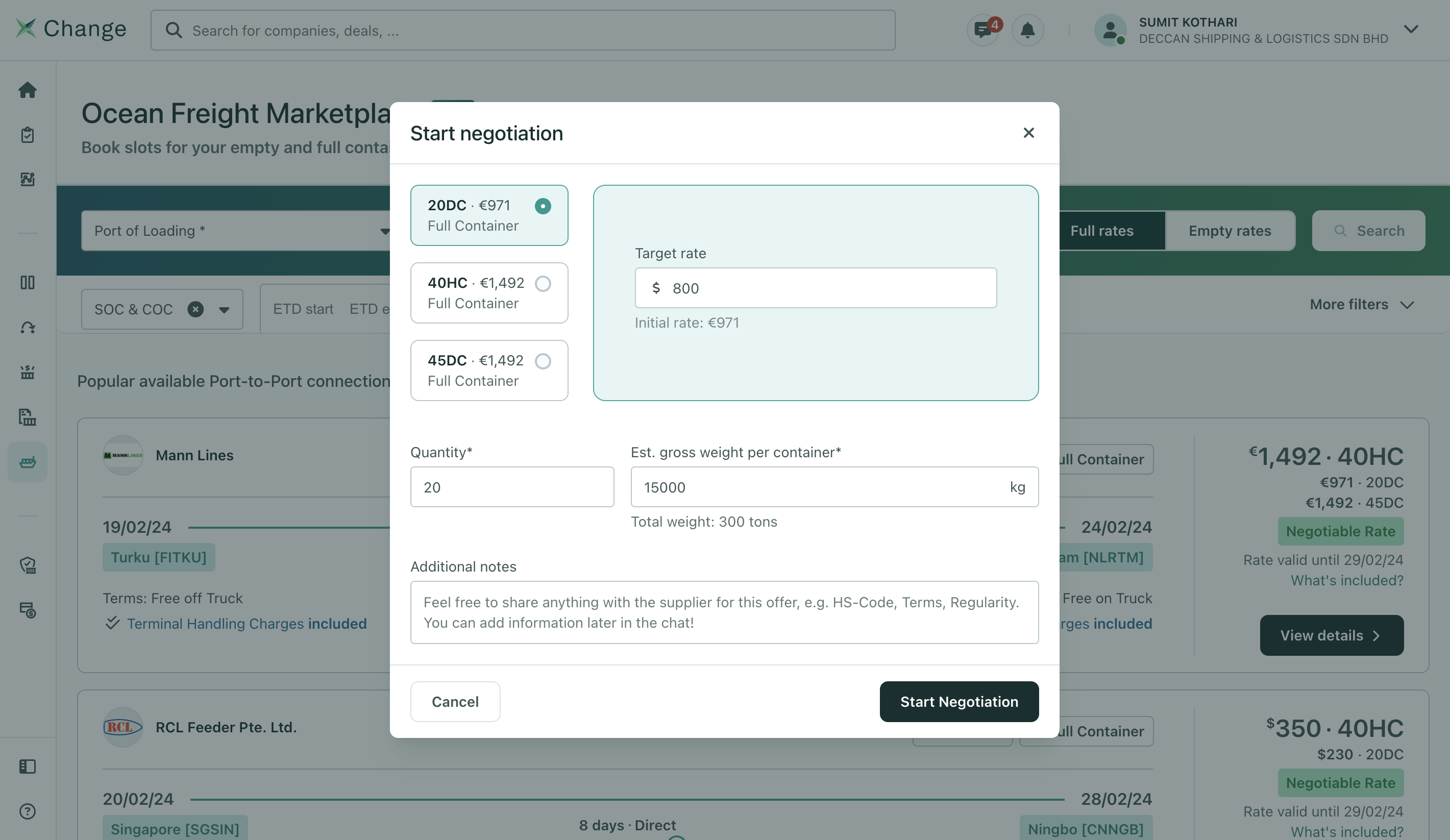

Starting a negotiation

We improved the entry point for the demand-side to start a negotiation. It now included multiple slot types & rates as well as the ability to add quantity and est. gross weight of the container. This information would be useful for the supplier to make a final offer.

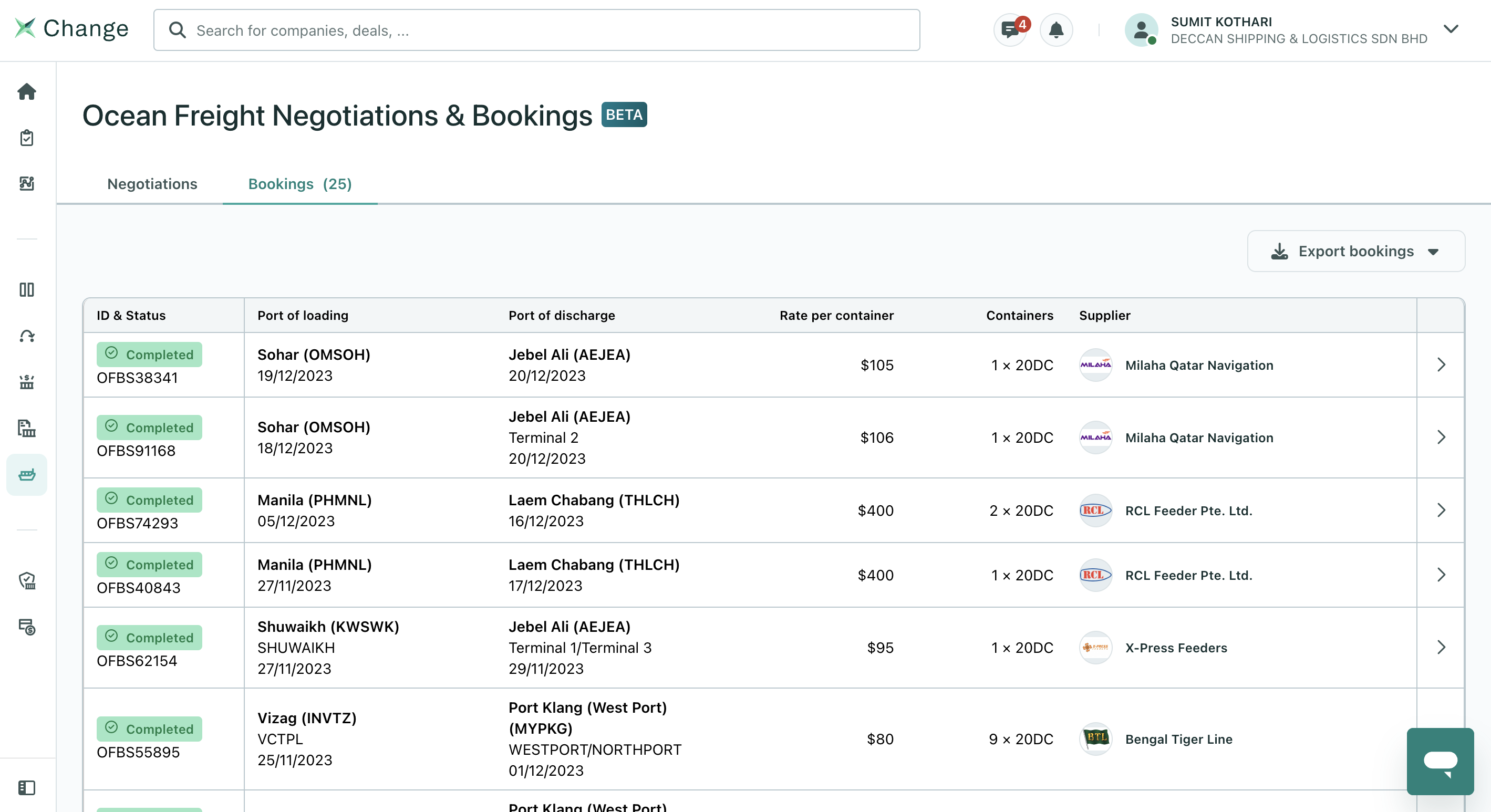

Negotiation & Booking overview

We implemented a new overview for ongoing negotiations and bookings. Each entry would link to a detail page where all documents, invoices and more information could be seen, e.g. for accounting purposes. We also enabled customers to export their past bookings as a CSV or XLS file.

Outcome

Unfortunately, just a couple of weeks before we could finish all features, this Ocean Freight project was stopped due to restructurings. We had been working with continuous delivery, so the majority of the features were already available to our customers. However, the full 100% were still missing. My efforts were pulled onto the xChange Trading marketplace (case study).